Photo taken on Dec. 30, 2019 shows the Pingtang Bridge in southwest China's Guizhou Province. (Xinhua/Liu Xu)

China's infrastructure stock per capita is about 20 percent to 30 percent of that of developed western countries, with weak areas in fields like transport, energy, environment protection.

BEIJING, Dec. 31 (Xinhua) -- A much-anticipated high-speed railway linking north China's Inner Mongolia Autonomous Region and Shanxi Province kicked off construction on Christmas, set to give a big gift for regional economic growth.

The project is a beneficiary of China's policies to boost effective investment, which plays a key role in maintaining the country's steady economic growth in 2019.

China would expand effective investment as appropriate, the government work report said in March.

Boosted by robust investment in the high-tech sector and social services, China's fixed-asset investment grew 5.2 percent year on year in the first 11 months of 2019, amounting to 53.37 trillion yuan (about 7.6 trillion U.S. dollars).

Aerial photo taken on Dec. 16, 2019 shows a railway bridge near the Da Qaidam Station along the Dunhuang-Golmud railway in northwest China's Qinghai Province. A new railway linking Dunhuang city, northwest China's Gansu Province, and Golmud city, northwest China's Qinghai Province, fully opened on Wednesday. (Xinhua/Zhang Long)

WEAK AREAS FIRST

From January to November, infrastructure investment grew 4 percent year on year, 0.2 percentage points lower than that from January to October.

China's infrastructure stock per capita is about 20 percent to 30 percent of that of developed western countries, with weak areas in fields like transport, energy, environment protection, according to the National Development and Reform Commission (NDRC).

China decided in July that targeted investment would be made to renovate old urban communities, parking lots and urban and rural cold chain logistics facilities.

The State Council, China's cabinet, decided later in an executive meeting to expand the scope for the use of special bonds to another 10 fields, including railways and toll roads.

The meeting pointed out that funds raised from the special bonds should not be used in areas related to land reserve and real estate, for debt swap, or for industrial projects that can be fully developed commercially.

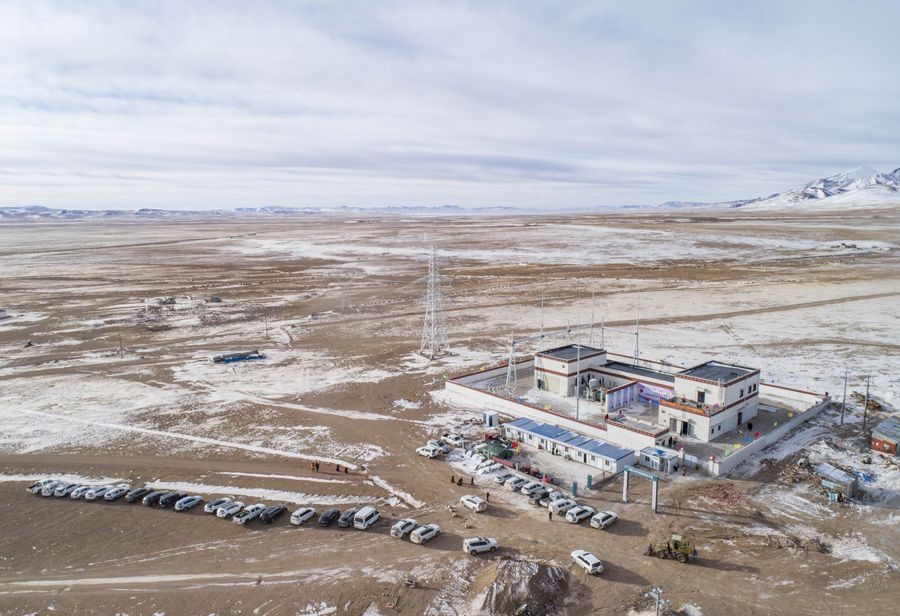

Aerial photo taken on Dec. 24, 2019 shows a 110 kV power transmission station in Tsonyi County, Nagqu City, southwest China's Tibet Autonomous Region. The world's highest county, Tsonyi, Nagqu City, southwest China's Tibet Autonomous Region, was connected to China's state grid Tuesday, enabling a stable power supply for more than 7,000 local residents. (Xinhua/Sun Fei)

STEADY CAPITAL SUPPORT

To boost investment, China introduced a slew of measures to further optimize the capital fund management of fixed-asset investment projects.

The minimum proportion of capital contribution for some infrastructure projects will be lowered as appropriate, with that of port, coastal and inland waterway transport projects to be cut from 25 percent to 20 percent, according to a circular issued by the State Council.

Besides, China has expanded and accelerated the issuance of special-purpose local government bonds aimed at financing public-interest projects.

In the first 11 months, local governments issued 2.55 trillion yuan worth of special bonds. China also allocated ahead of schedule part of next year's special bonds quota worth 1 trillion yuan.

These new policies will help the financing of infrastructure projects, which undoubtedly played an important role in promoting steady investments, said Wu Yaping, a senior researcher with the Investment Research Institute under the NDRC.

The newly started high-speed railway project was one of the projects enjoying capital support from special bonds.

The public-private partnership investment model, which introduces private investment, had financed some 9,000 projects by early December, official data showed.

To regulate the use of special bonds, the government has stressed enhanced project management to avoid uncompleted projects. Several local governments have put into place platforms to monitor the progress of local projects. ■