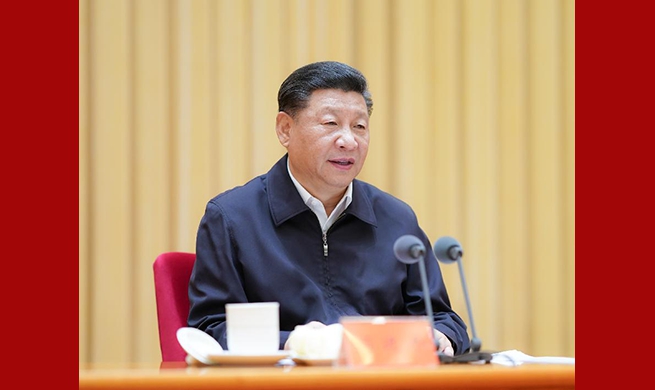

U.S. Federal Reserve Chairman Jerome Powell testifies before the House Financial Services Committee on the state of the U.S. economy, on Capitol Hill in Washington D.C., the United States, on July 10, 2019. Jerome Powell said Wednesday that crosscurrents such as trade tensions and concerns about global growth have been weighing on the U.S. economic activity and outlook. (Xinhua/Liu Jie)

WASHINGTON, July 10 (Xinhua) -- U.S. Federal Reserve Chairman Jerome Powell said Wednesday that uncertainties hanging over global growth and trade tensions show little sign of abating recently, sending a strong signal that the central bank would cut interest rates later this month.

The central bank chief also said he would not quit his job even if President Donald Trump asked him to.

RATE CUT SIGNAL

Testifying before the House Committee on Financial Services on the Fed's Semiannual Monetary Policy Report, Powell said crosscurrents such as trade tensions and concerns about global growth have been weighing on the U.S. economic activity and outlook.

The chairman said in his prepared remarks that at the June meeting of the Federal Open Market Committee (FOMC), "many FOMC participants saw that the case for a somewhat more accommodative monetary policy had strengthened." The FOMC is the Fed's policy-making body.

"Since then, based on incoming data and other developments, it appears that uncertainties around trade tensions and concerns about the strength of the global economy continue to weigh on the U.S. economic outlook. Inflation pressures remain muted," he said.

Shortly after the hearing wrapped up, the Fed released the minutes of the June 18-19 FOMC meeting.

"Participants judged that uncertainties and downside risks surrounding the economic outlook had increased significantly over recent weeks," read the minutes, adding that nearly all FOMC participants had revised down their assessment of the appropriate path for the federal funds rate.

The minutes said several FOMC participants noted that a near-term rate cut was "appropriate" from a risk-management perspective, as it "could help cushion the effects of possible future adverse shocks to the economy."

Powell was asked at the hearing by Carolyn Maloney, Democratic representative from the state of New York, if the Fed considers a half-percentage-point lowering of the benchmark interest rate during the July 30-31 FOMC meeting. He responded by saying "we'll be looking at a full range of data," without offering any other clues.

RISKS FACING U.S. ECONOMY

While acknowledging that the Fed's "baseline outlook is for economic growth to remain solid," Powell spent much of the time during the hearing explaining the risks facing the U.S. economy.

He said Fed officials were mindful of headwinds in global growth and trade as early as the May FOMC meeting, when "these crosscurrents have re-emerged, creating greater uncertainty."

Those concerns, the chairman said, "may have contributed to the drop in business confidence in some recent surveys and may have started to show through to incoming data."

Powell said growth in business investment has slowed "notably," and "overall growth in the second quarter appears to have moderated."

After the June FOMC meeting, the Fed predicted that the U.S. real GDP will grow 2.1 percent in 2019, with the pace slowing down to 2 percent in 2020 and dropping further to a rate of 1.8 percent in 2021, according to the median projections of Fed Board members and Federal Reserve bank presidents.

On inflation, Powell told the lawmakers that while it has been below the FOMC's symmetric 2 percent objective, "there is a risk that weak inflation will be even more persistent than we currently anticipate."

The core personal consumption expenditure price index, the Fed's preferred inflation gauge that excludes volatile food and energy prices, rose 1.6 percent year on year in May, below the 2 percent target.

As regards the labor market, which added a higher-than-expected 224,000 jobs in June, Powell said there has been no evidence yet "for calling this a hot labor market." He said although the June unemployment rate remains at a low level of 3.7 percent, "to call something hot you have to see heat."

The central bank chief in his testimony also warned of a number of "important longer-run challenges" which he said the United States "continues to confront."

One of those challenges, according to Powell, is the longer-term effect of high and rising federal debt. He told lawmakers that "it's essential that Congress raise the debt ceiling in a timely way so that the United States continues to pay its bills when and as due."

The Bipartisan Policy Center, a Washington think tank, warned Monday that Congress will have to raise the federal debt limit in the first half of September, otherwise "the federal government can no longer pay all of its bills in full and on time."

Trump signed an executive order on Feb. 9, 2018, suspending the debt ceiling until March 1, 2019, when the national debt exceeded 22 trillion U.S. dollars. House Speaker Nancy Pelosi, Democrat from California, said Tuesday that Congress will possibly vote on a debt limit increase before the August recess.